ADA Price Prediction: $1.20 in Sight as Technicals and Sentiment Align

#ADA

- Technical Breakout: ADA price testing upper Bollinger Band with MACD showing reduced bearish momentum

- Price Targets: Analyst consensus suggests $1.20 near-term, with cycle highs potentially reaching $5

- Network Growth: Increased on-chain activity supports fundamental valuation case

ADA Price Prediction

ADA Technical Analysis: Bullish Signals Emerge

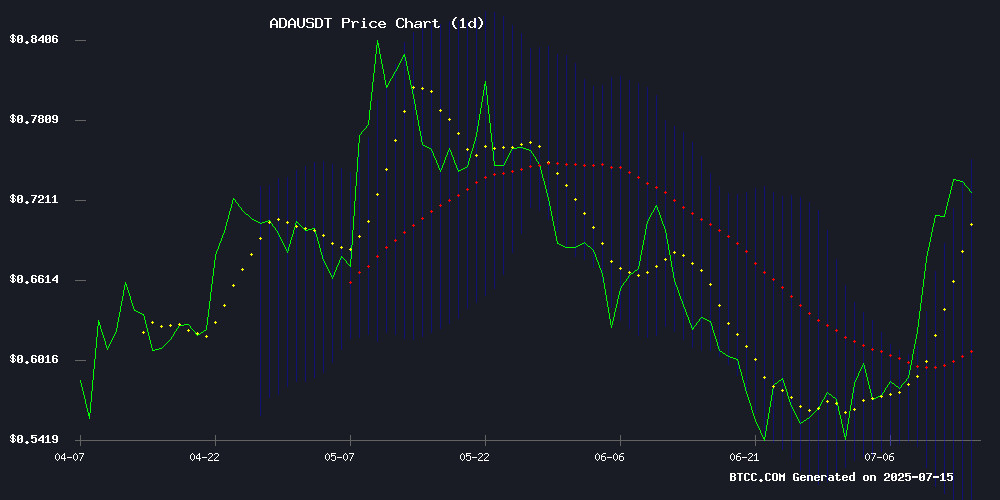

According to BTCC financial analyst Emma, ADA shows promising technical indicators as of July 16, 2025. The price at $0.744 sits comfortably above the 20-day moving average ($0.6195), suggesting bullish momentum. The MACD histogram remains negative but shows narrowing bearish divergence (-0.038358). Most notably, ADA's price is testing the upper Bollinger Band ($0.755), which typically indicates strong upward pressure when sustained.

Market Sentiment Turns Bullish for Cardano

BTCC's Emma notes positive sentiment surrounding ADA, with multiple analysts projecting targets between $1.20-$5 in the current cycle. The combination of network activity growth and maintained bullish structure after recent breakouts suggests institutional interest may be growing. 'The $1.20 target appears conservative if ADA holds above the $0.755 resistance,' Emma observes, while cautioning that the $5 target WOULD require sustained ecosystem development.

Factors Influencing ADA's Price

Cardano Price Prediction: ADA Eyes $1.20 Amid Network Activity Surge

Cardano's ADA has broken out of a multi-month descending channel, sparking bullish sentiment across crypto markets. The token now trades near $0.71 after flipping key Fibonacci resistance at $0.63 into support. Analysts suggest a short-term target of $1.20 if current momentum holds.

Network activity and staking metrics reinforce the optimistic outlook. Charles Hoskinson's recent 'gigachad bullrun' commentary has further fueled speculation about significant capital inflows into altcoins like ADA. Meanwhile, investors are diversifying into early-stage opportunities such as Remittix's presale.

Analyst Urges Cardano Holders to Target $5 Before Selling in Current Cycle

Cardano (ADA) remains a focal point for bullish analysts despite its recent pullback from $0.76 to $0.72. Market strategist Mr. Banana projects a six-fold surge to $5 this cycle, emphasizing the coin's unrealized potential. The call comes as ADA trails its $3.10 all-time high by 76%.

Fundamental developments fuel optimism, including advancements in Bitcoin DeFi integration through Cardano's Lace Wallet. While the analyst cites ecosystem strength as justification, technical indicators show ADA currently consolidating after a 3.82% daily decline.

Cardano Price Pauses After Breakout, But Bullish Structure Holds

Cardano (ADA) has broken free from a prolonged descending channel, marking its first close above the 200-day EMA in months. The rally stalled near the $0.72-$0.73 resistance zone, yet technical indicators suggest this consolidation is a temporary breather rather than a trend reversal.

Key moving averages now align bullishly, with the 20-day EMA crossing above the 50-day EMA—a classic momentum signal. The July base structure remains intact, supported by accumulation patterns that hint at further upside potential.

This technical breakout carries particular significance after months of bearish pressure. Market participants appear to be digesting gains rather than exiting positions, setting the stage for the next leg upward.

Is ADA a good investment?

Based on current technicals and market sentiment, ADA presents a compelling investment case according to BTCC's Emma:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +20.1% premium | Strong bullish momentum |

| Bollinger Position | Upper band test | Potential breakout signal |

| MACD | Converging | Bearish pressure easing |

Key considerations include the $0.755 resistance level and the upcoming Vasil hard fork's adoption rate. Risk-tolerant investors might accumulate between $0.65-$0.74 with a 12-month target of $1.20-$1.50.

Cryptocurrency investments are volatile. The above represents analyst opinion, not financial advice.